Arriving in Chongqing for the first time might seem a bit busy, but getting from the airport to the city is actually smooth and simple. Once you land at Jiangbei International Airport (CKG), you’ll find several transport options that suit every budget and schedule. Whether you take the metro, airport bus, or a taxi, reaching downtown areas like Jiefangbei, Shapingba, or Guanyinqiao is quick and convenient. Even if you arrive late at night, it’s easy to find a safe and comfortable ride into the city.

🛬 How to Get from Chongqing Airport to the City

Arriving in Chongqing might feel a bit busy at first, but getting to the city is actually simple once you know your choices. Whether you’re heading to Jiefangbei, Yuzhong, or Shapingba, there are many easy ways to reach your hotel from Jiangbei International Airport (CKG). Here’s a quick guide for Filipino travelers to help you pick the best option based on your time, budget, and comfort.

✈️ From Jiangbei International Airport (CKG) to City

| Transport Option | Where to Find It | Travel Time | Cost (CNY / PHP) | Convenience | Best For | Extra Info |

|---|---|---|---|---|---|---|

Metro Line 10 + Line 3 | Airport Metro Station (basement level) | 35–50 mins | ¥7–9 / ₱55–70 | ⭐⭐⭐⭐ | Budget travelers, first-timers | Transfer at Hongtudi or Lijia to reach downtown Jiefangbei |

Airport Shuttle Bus | Outside arrivals terminal | 40–60 mins | ¥20–25 / ₱160–200 | ⭐⭐⭐ | Travelers with luggage | Buses go to main areas like Jiefangbei, Shapingba, and Nanping |

Taxi | Official taxi stand at arrivals | 35–50 mins | ¥80–120 / ₱630–950 | ⭐⭐⭐⭐ | Families, late-night arrivals | Always use the official taxi queue to avoid scams |

DiDi (Ride-hailing app) | Book via app | 35–50 mins | ~¥90–130 / ₱710–1,000 | ⭐⭐⭐⭐ | App users, small groups | Type your hotel name in Chinese for better accuracy |

Private Transfer | Pre-book online (Trip.com) | 35–50 mins | ₱1,800+ (2–3 pax) | ⭐⭐⭐⭐⭐ | Comfort, stress-free travel | Driver meets you at arrivals holding a sign with your name |

Car Rental | Counters at arrivals area | Flexible | From ¥250 / ₱2,000+ per day | ⭐⭐⭐ | Experienced drivers |

🚇 Chongqing Airport Metro: Your Easy Ride to the City

Taking the metro from Chongqing Jiangbei International Airport (CKG) is one of the most convenient and affordable ways to reach the city. If you’ve tried the MRT in Manila, this will feel familiar but cleaner, quieter, and more spacious. The trains are air-conditioned, safe, and easy to navigate even for first-time visitors.

🛤️ Train Line & Route

Sources: Wikipedia

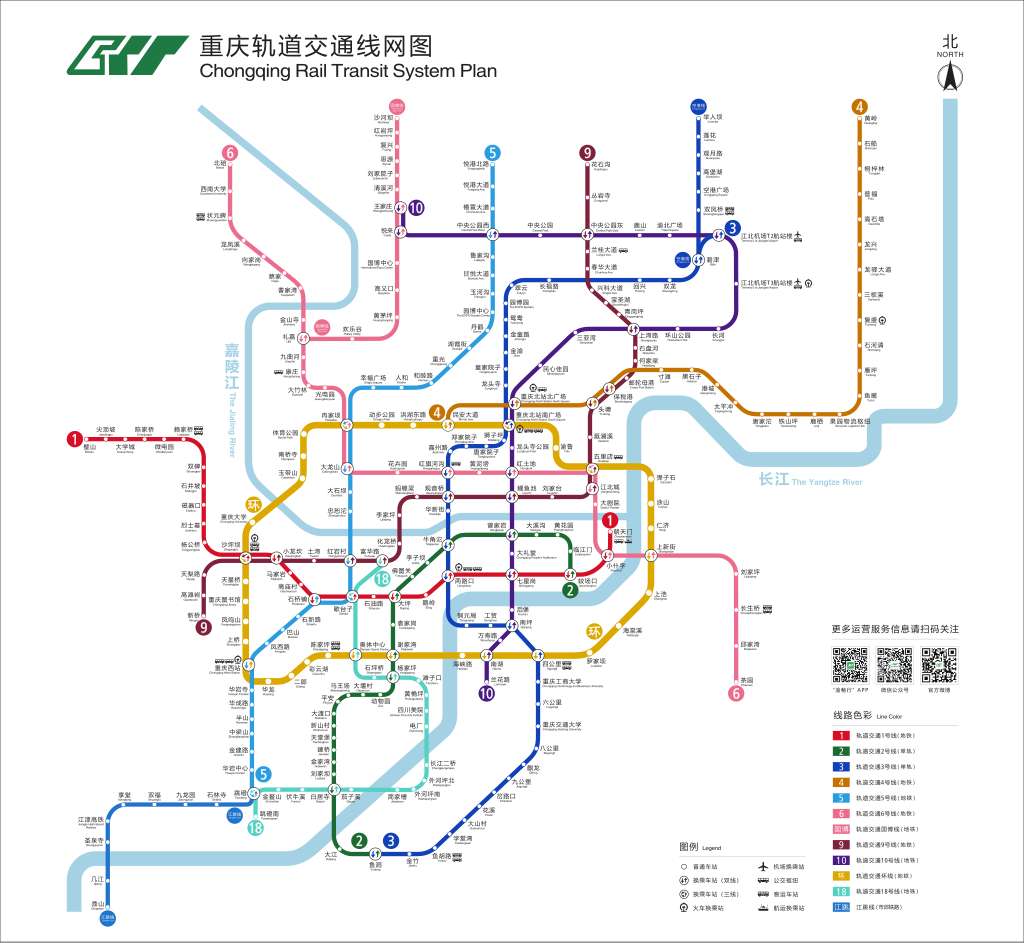

Metro Line 10 + Line 3

- Station: Jiangbei Airport Station (connected directly to Terminals 2 and 3; follow signs for “Metro / 地铁”).

- Route: Airport (Line 10) → Hongtudi (transfer to Line 3) → Guanyinqiao → Lianglukou → Yuzhong → Jiefangbei.

- Key Transfers:

- Hongtudi: Change here from Line 10 to Line 3.

- Guanyinqiao: Popular area for shopping and restaurants.

- Lianglukou: Connects to Chongqing Railway Station.

- Xiaoshizi: Closest stop to Jiefangbei, Chongqing’s main downtown area.

🕒 Operating Hours

- First train: Around 6:30 AM (Airport → City)

- Last train: Around 10:30 PM (Airport → City)

- Frequency: Every 6–10 minutes depending on the time of day.

💸 Ticket Price

- Standard fare: ¥7–9 (₱55–70), depending on your destination.

- How to pay:

- Ticket machines (accept cash and coins).

- Transport cards like Chongqing Tong.

- QR code payment via Alipay or WeChat Pay.

🚌 Chongqing Airport Shuttle Bus: Easy and Budget-Friendly Ride to the City

If you want a cheap and simple way to reach downtown from Chongqing Jiangbei International Airport (CKG), the airport shuttle bus is a good choice. It’s comfortable, convenient for travelers with big luggage, and takes you straight to major city areas without needing to change trains.

🚍 Where to Find the Bus

- After collecting your luggage, head to the Arrival Hall in Terminals 2 or 3.

- Follow the signs that say “Airport Shuttle Bus (机场大巴)”.

- You can buy your ticket at the counters inside the terminal or from vending machines.

- The buses are parked at the official shuttle platforms just outside the arrival area.

📍 Main Routes & Destinations

| Route | Approx. Fare | Drop-off Points | Why Choose It |

|---|---|---|---|

CKG → Jiefangbei | ¥20 (~₱160) | City center, shopping and food areas | Best for tourists staying downtown |

CKG → Shapingba District | ¥20 (~₱160) | Near universities and local food spots | Ideal for long stays or local experience |

CKG → Nanping District | ¥25 (~₱200) | South side of the Yangtze River | Perfect for business travelers |

CKG → Chongqing North Railway Station | ¥15 (~₱120) | High-speed train hub | Good if you’re catching trains to other cities |

CKG → Liangjiang New Area | ¥20 (~₱160) | New business area with hotels | Great for work trips and short stays |

⏱️ Travel Time

The ride usually takes 40–60 minutes, depending on your route and traffic. Buses leave every 20–30 minutes, starting from 6:30 AM until around 10:30 PM.

💳 How to Ride the Airport Bus

- Go to the ticket counter or machine in the Arrival Hall.

- Tell the staff your destination (for example, “Jiefangbei” or “Shapingba”).

- Pay by cash (RMB) or bank card.

- Take your ticket and check the platform number printed on it.

- Wait at the platform until your bus arrives and hop on.

🚖 Taxi & 📱 DiDi (Ride-Hailing): Easy and Comfortable Ride to Chongqing City

If you want a smooth and direct trip from Chongqing Jiangbei International Airport (CKG) to your hotel, taking a taxi or booking a DiDi is the most convenient choice. Both options are safe, reliable, and perfect if you’re arriving late, have big luggage, or are traveling with your family.

🚖 Taxi

📍 Where to Find Taxis

- The official taxi stand is right outside the Arrivals Hall in Terminals 2 and 3.

- Follow signs for “Taxi / 出租车” after leaving the baggage claim area.

- Airport staff can assist you in finding the correct queue.

💸 Fares & Travel Time

- Downtown (Jiefangbei, Yuzhong District): ¥80–120 (~₱630–950)

- Travel time: About 35–50 minutes, depending on traffic.

✅ Why Choose a Taxi

- Direct drop-off to your hotel, no transfers needed.

- Best choice for late-night arrivals when metro or buses have stopped.

- Comfortable for travelers with children or heavy luggage.

- Always use the official taxi queue to avoid overcharging or scams.

⚠️ Tip: Traffic can be heavy during rush hours (around 7–9 AM and 5–7 PM), so try to plan your trip if possible.

📱 DiDi (Ride-Hailing App)

🚗 How to Book

- Download the DiDi app on your phone (available on iOS and Android).

- You can switch the app to English mode in the settings.

- Pay easily through WeChat Pay, Alipay, or an international credit card.

💸 Fares & Travel Time

- About the same as a taxi: ¥90–130 (~₱710–1,000) to central Chongqing.

- Travel time: Around 35–50 minutes, depending on traffic.

✅ Why Choose DiDi

- No need to queue at the taxi stand.

- You’ll see the estimated fare before confirming your ride.

- Choose a car type based on your comfort and budget:

- Express: Cheaper, best for solo travelers.

- Premier: More comfortable and spacious.

- Luxe: High-end cars for a relaxing ride.

✨ Traveler Tip

Take a taxi if you want a quick, direct ride right after you land.

Choose DiDi if you prefer an app-based, cashless option with clear pricing and no waiting in line.

🚘 Private Transfer: Smooth and Comfortable Ride to Chongqing City

If you want a relaxing and stress-free way to start your trip in Chongqing, booking a private transfer is the most comfortable option. You can arrange it before your flight, and once you arrive, your driver will be waiting at the arrival hall to take you straight to your hotel. It’s perfect if you’re feeling tired after a long flight, traveling with family, or carrying several bags.

🚍 Where to Book

- Book online through trusted platforms like Trip.com.

- Your driver will meet you at the arrival hall, holding a sign with your name.

- You can also choose a bigger car or van if you’re traveling with a group.

💸 Fares & Travel Time

- Downtown areas (Jiefangbei, Yuzhong District): from ₱1,800+ (for 2–3 passengers)

- Travel time: Around 35–50 minutes, depending on traffic.

- Premium sedans and vans are available for families, groups, or business travelers.

✅ Why Choose a Private Transfer

- Fixed price with no hidden fees.

- Door-to-door service, so no need to find a taxi or carry heavy bags.

- Meet-and-greet service at the airport with luggage assistance.

- Ideal for those who want a comfortable, safe, and easy start to their Chongqing trip.

🚘 Car Rental: Explore Chongqing at Your Own Pace

If you want the freedom to explore Chongqing and its nearby areas without depending on public transport, renting a car from the airport is a great choice. It lets you travel comfortably at your own schedule and stop anywhere you like, perfect for those planning to visit scenic spots or nearby towns.

🚗 Where to Rent a Car

- Car rental counters are located in the Arrival Hall of Chongqing Jiangbei International Airport (CKG).

- Major companies such as Hertz, Avis, and eHi Car Services operate there.

- You can also book online in advance through platforms like Trip.com for better rates and guaranteed availability.

💸 Rates & Travel Time

- Daily rental: starts from around ¥250–400 (~₱2,000–3,200) depending on the car type.

- Travel time to downtown (Jiefangbei/Yuzhong District): about 35–50 minutes.

✅ Why Choose Car Rental

- Full freedom and flexibility to explore Chongqing and nearby areas.

- Comfortable and private, great for families or small groups.

- Ideal for day trips to places like Ciqikou Ancient Town, Wulong Karst, or Three Gorges area.

✈️ What’s the Best Way from Chongqing Airport to the City?

Just arrived in Chongqing and wondering how to get downtown? Don’t worry, kabayan! Whether you’re watching your budget, traveling with family, or landing late at night, there’s always a convenient way to reach the city from Jiangbei International Airport (CKG). Here’s a quick guide to help you choose what fits your travel style best:

| Travel Style | Best Option | Why It Works |

|---|---|---|

Budget Traveler | 🚇 Metro Line 10 + Line 3 or 🚌 Airport Shuttle Bus | Metro is cheap and efficient, while the bus is ideal if you have big luggage. |

First-Time Visitor | 🚇 Metro Line 10 + Line 3 | Easy to follow with clear English signs and stops near downtown areas like Jiefangbei. |

Group or Family | 🚖 Taxi or 📱 DiDi Ride | Comfortable, direct, and plenty of space for bags and kids. |

Late-Night Arrival | 🚖 Taxi or 🚘 Private Transfer | Safe and convenient when metro and buses are no longer running. |

Comfort Seeker | 🚘 Private Transfer (Trip.com) | Driver meets you at the arrival hall, fixed price, and stress-free ride straight to your hotel. |

No matter if you’re staying in Jiefangbei, Shapingba, or Nanping, getting from Chongqing Airport to the city is quick, safe, and simple. Just choose the option that matches your comfort level, schedule, and budget.

🇨🇳 Enjoy your trip, kabayan! Welcome to Chongqing, the city of mountains and hotpot! 🌆🔥

❓ FAQs: Chongqing Airport to City

How far is Chongqing Jiangbei International Airport from downtown?

The airport is about 25–30 km from the city center (Jiefangbei area). Depending on traffic, it takes around 35–50 minutes by car or taxi.What is the cheapest way to get from the airport to the city?

The metro (Line 10 + Line 3) is the cheapest option, costing only ¥7–9 (~₱55–70). It’s fast, clean, and has English signs for easy navigation.Are taxis safe and easy to find at Chongqing Airport?

Yes. Official taxis are safe and metered. The taxi stand is right outside the Arrivals Hall. Always queue at the official line and avoid unlicensed drivers.How can I pay for transportation in Chongqing?

Most public transport accepts cash (RMB), Chongqing Tong cards, or QR code payments via Alipay and WeChat Pay.Which option is best for first-time visitors?

For most travelers, the metro is the best mix of price and convenience. It’s safe, fast, and connects directly to key downtown areas like Jiefangbei and Guanyinqiao.