In the Philippines, all individuals going abroad are required by the local government to pay travel tax, as provided by Presidential Decree 1183. Here’s all you need to know about Philippine Travel Tax, and how you can have a hassle-free travelling experience with Trip.com Ph’s travel tax inclusive fares!

What Is the TEC?

The Travel Tax Exemption Certificate is an official document proving that you are not required to pay the Philippine travel tax when leaving the country.

- OFWs can usually just present their Overseas Employment Certificate (OEC) instead, but some airlines may still ask for a TEC.

Who Can Get a Travel Tax Exemption

You may qualify if you are:

- An Overseas Filipino Worker (OFW)

- A Filipino permanent resident abroad staying in the Philippines for less than a year

- An infant aged 2 years or below

- A diplomat, UN personnel, or government official on official travel

- A scholarship grantee or a dependent of one

- A crewmember, exporter, Balik Scientist, or other categories covered under travel tax law

How much is the travel tax?

The rates listed are according to the Tourism Infrastructure and Enterprise Zone Authority:

Travel Tax Rates | First Class Passage | Economy Class Passage |

Full Travel Tax | ₱ 2,700 | ₱ 1,620 |

Standard Reduced Travel tax | ₱ 1,350 | ₱ 810 |

Privileged Reduced Travel Tax for a Dependent of an Overseas Filipino Worker (OFW) | ₱ 400 | ₱ 300 |

How to Apply for a Travel Tax Exemption

1. Check If You Qualify for Exemption

You must belong to one of the exempt categories under Presidential Decree 1183 (as amended), such as:

- Overseas Filipino Workers (OFWs)

- Filipino permanent residents abroad whose stay in the Philippines is less than one year

- Infants (2 years old or younger)

- Diplomatic / consular officials, UN personnel, government officials traveling on official business, scholars, etc.

- Other special cases as allowed by treaties, laws, or presidential authorization

If you don’t qualify, you’ll need to pay the travel tax instead.

2. Gather the Required Documents

The documents you need depend on which exemption you claim. But commonly you’ll need:

- Valid passport (identification/bio page)

- Airline ticket or booking confirmation

- Recent 2×2 ID photo (within last six months)

- Specific supporting documents for your exemption category, such as:

• For OFWs: Overseas Employment Certificate (OEC)

• For diplomats / UN personnel: Certification from relevant bodies (e.g. Department of Foreign Affairs, UN agency)

• For scholars: Scholarship/academic certification from government agency

• For permanent residents abroad: proof of residency abroad, immigration stamps, etc.

Some embassies / consular offices also require a Certificate of Residency in certain cases. For example, the Philippine Embassy in Paris has a procedure for Certificate of Residency for travel tax exemption purposes.

3. Decide How to Apply (Online vs Onsite)

Option A – Online Application (Preferred, if time allows)

- Go to the official TEC Online Application portal (Online TIEZA TEC system)

- Fill out the application form, input your data, and upload scanned documents (passport page, booking, ID photo, etc.)

- The online system will process your application — within three (3) working days from the date all complete documents are submitted

- Important: Your flight date must be at least 3 days after the date of your online application. If your flight is sooner, you will need to apply onsite.

Note: Online applications beyond 5:00 pm or on Fridays, weekends, or holidays are considered submitted the next working day.

Option B – Onsite / Walk-In Application

- Visit a TIEZA Travel Tax Office, or counter at major airports (departure counters) or TIEZA offices

- Fill out the TEC application form (paper)

- Submit original documents and photocopies

- If your documentation is complete, TEC may be issued on the spot (within the hour) depending on workload

Some airlines may assist with checking exemption but don’t always issue TEC themselves — the issuance authority remains with TIEZA.

4. Use the TEC at Departure

- Present your TEC to the airline / check-in staff when leaving the Philippines

- The TEC is typically for that particular trip / flight

- It is nontransferable and single-use

- Always carry the original TEC and supporting documents

5. Special / New Systems and Notes

- TIEZA has an Online Travel Tax Services System (OTTSS) for paying travel tax (for those who are not exempt) through digital channels.

- Recently, the eTravel App / eGov PH integration now requires you to pay the travel tax via eTravel (if you need to pay) before generating your eTravel QR code.

- If you paid full travel tax but you were eligible for a reduced rate (RTT), you can apply for refund of excess amount onsite at TIEZA offices or airport counters.

How to Pay Travel Tax Easily with Trip.com?

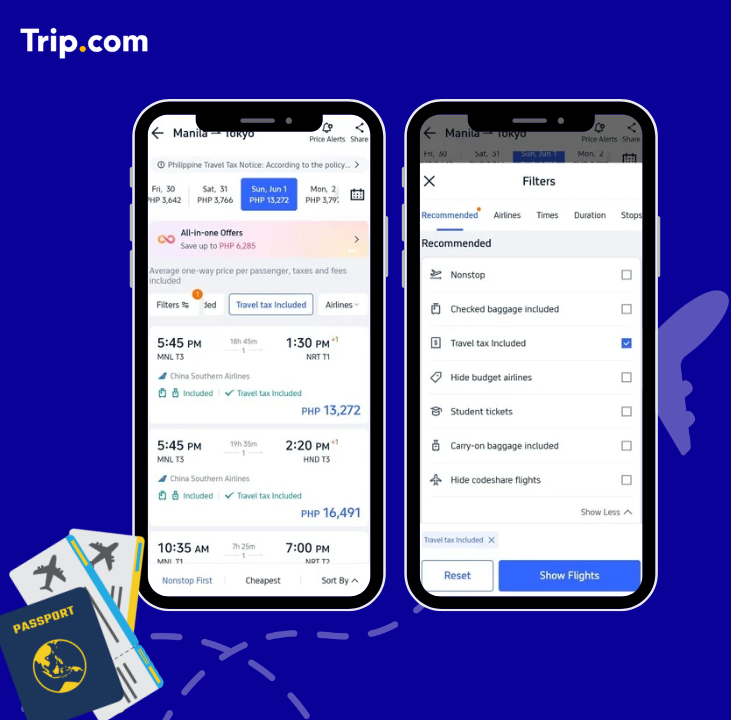

Did you know that you can now conveniently book your flight and pay for Travel Tax at once? Trip.com’s fares are now TRAVEL TAX INCLUSIVE!

Our displayed fares on Trip.com website and app already include Travel Tax! Booking flights to your dream destinations has never been easier!

*Photo included is just a sample.

When searching for flights in the Trip.com app and website, we have a filter for Travel Tax inclusive flights so that you can improve your browsing experience. Once the fare is paid, you no longer need to wait long hours in line at the airport counter to pay the tax!

*Photo included is just a sample.

Travel Made Simpler with Trip.com

Paying the Philippine Travel Tax is a necessary step when traveling abroad, but it doesn't have to be stressful. By understanding who needs to pay, knowing your options, and planning ahead, you can ensure a smooth airport experience. Even better, with Trip.com's Travel Tax Inclusive fares, you can skip the hassle entirely and focus on what really matters — your next great adventure!

Ready to fly? Book with Trip.com today and make your travels even more worry-free!

FAQ: Philippine Travel Tax

Do balikbayans pay travel tax?

- If you are a balikbayan who is a Filipino permanent resident abroad and you’ve stayed in the Philippines less than one year, you are exempt.

- If you have stayed over one year, the exemption no longer applies and you will need to pay the tax.

Is travel tax refundable? Yes.

If you paid the travel tax but were actually eligible for exemption or reduction, you may apply for a refund through the Tourism Infrastructure and Enterprise Zone Authority (TIEZA). You will need your proof of exemption and the official receipt of payment. Refunds take around 30 to 90 days to process, with a ₱200 processing fee.How long is the TEC valid?

One year from the date of issue, or for the specific flight listed on the certificate. Single-use only.What happens if I don’t pay the travel tax?

You won’t be allowed to check in for your flight until it is paid or you present valid proof of exemption.If my ticket was refunded, can I also get the travel tax back?

Yes, but you need to process a travel tax refund separately with TIEZA, presenting your proof of payment and refund details from the airline.